Utilizing China's enormous biomass potential is one of the priorities of the Chinese government. Not only as an additional method to improve energy independence and reduce net carbon emissions but also to further stimulate economic development of rural areas. The government intends to increase the current usage of biomass 10-fold, primarily through feed-in tariffs. Opportunities across technologies remain therefore large, and short payback times can be achieved, but, at the same time, reaching scale can be complex, with local conditions varying substantially.

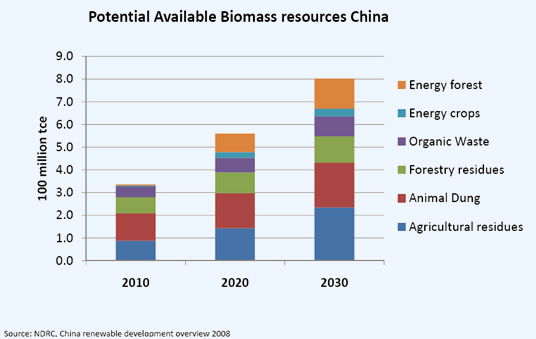

Currently China has around 4 GW total biomass based power generation with the objective to increase to 30 GW by 2020, most of which from (co-)combustion and gasification of crop residues. China¡¯s biogas production objective stands at 44 bcm by 2020. The total potential acquirable biomass (a subset of the theoretical potential) is even more, with estimates varying between 300 and 800 mtce (million ton coal equivalent) per year, roughly equal to the total electricity consumption in Europe.

The graph below provides an overview of the estimated potential acquirable biomass resources in China. The forest and dung acquirable quantity shown in this graph, are around 10 times lower than the total theoretical potential. Currently, over 50% of the potential crop residue resources in China are from Maize and Wheat.

Geographically, wood resources are mostly concentrated in the large southern and eastern areas in Tibet, Sichuan and Yunnan, whereas the top two provinces for crop residues and dung waste are located in China¡¯s ¡®Wheat belt¡¯ in Shandong and Henan.

China¡¯s leading biomass player is Dragon power who claims to command around 60% of the total China biomass to power market. Beyond that, many other companies have established individual plants, some very profitable, although in individual cases the continued availability of low cost biomass material is a challenge.

In July 2010, the National Reform and Development Committee (NDRC) reconfirmed its commitment to the biomass sector by establishing a feed-in tariff of CNY0.75 (€0.08) per kWh across the country (before than it was lower and varied across the country). Since then, the biomass market started to accelerate further, with many new players trying to establish a position.

The NDRC¡¯s priority sectors are biomass power, biogas, biomass pellets and liquid biofuels. The large regional variations in feedstock and feedstock availability can create very different local conditions in which different technologies and business models will emerge as the most attractive.

|